Last Updated on December 31, 2020 by ITPM

Ready to try one of these Pinoy Savings Challenge? During difficult times, a lot of people are put in a position where they wish that they have savings set aside. As we say in Tagalog, “Kapag may isinuksok, may madudukot.“

Before starting with a Pinoy savings challenge, make sure that you assess your current income and spending. Estimate how much is your ‘essential’ spending. This way, you can really sustain any savings challenge that you want to start with.

What is Essential Spending?

Think of your spending as divided into 3: (1) Fixed; (2) Flexible; and (3) Discretionary.

Fixed are those that have fixed / determined amounts that you have to follow. Examples include rent for your house; loan payments; and even tuition fee installments for your kid’s school.

Flexible are regular and necessary spendings, but the amount is not fixed. You have some control on these, so you can adjust to make it lower, though not necessarily take these out. Examples include weekly grocery budget; maintenance medicines (only if you can swap to cheaper / generic brands); how much you spend on your phone / load; and to a certain extent, your water and electricity bills.

Discretionary spending is all the other expenses that you may choose to give up to a certain extent. These can include ‘me-time spending’ like movies; shopping money; dining out; grooming/salon expenses, and even travel.

Most Popular Pinoy Savings Challenges

There are many Pinoy savings challenges to choose from. But before starting on one, make sure that you can COMMIT to it. Set a realistic goal on how you really would want to save. Make sure that you have gone through your expenses so that you know how much you really can lower these.

PRO-TIP: Look at your savings as

INCOME – SAVINGS = EXPENSES

The other way is INCOME – EXPENSES = SAVINGS. But this view will push you to put savings are your last priority.

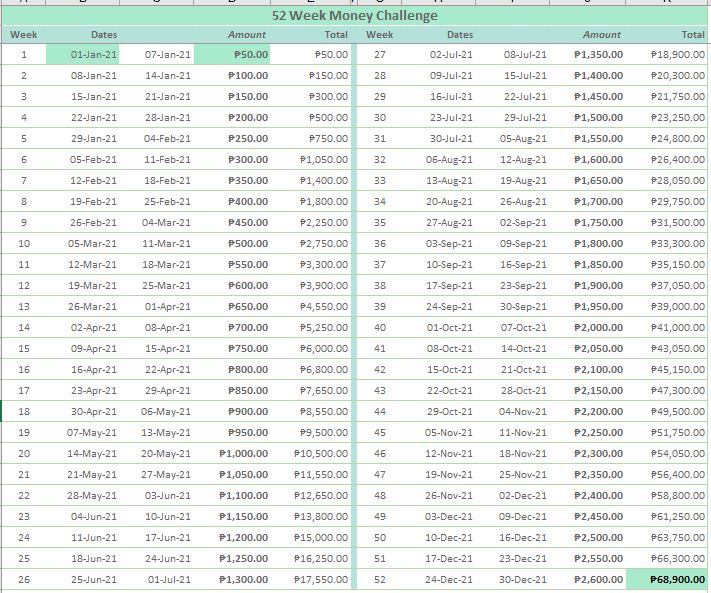

52-Week Pinoy Money Challenge

This Pinoy savings challenge involves setting an amount that will be set aside weekly. The amount usually starts small, and increases in weekly increments as you go through the weeks.

For instance, if you start at P10 on week 1; you need to set aside P20 on the following week; P30 on the 3rd week; and so on. As the amounts change on succeeding weeks, there are a lot of online templates you can use for this. It’s popular among Pinoys since you have to put in savings every week. Also, it shows you how much you will get at the end of the year, and the savings potential is really big.

However, it can be confusing for some since the amounts are different every week. Thus, the templates / checklist is available for this as a guide. Also, some people get overwhelmed as the amount can be quite huge towards the end, especially if you started with a big amount. For instance, if you start with P50, you would need to put in more than P2,400 weekly during the last few weeks.

Download (Go to File –> Download –> Microsoft Excel (.xlsx)) the sheet so that you can edit it accordingly.

Set the starting week you want; and the increment you want to commit to. Print it out so you can mark as you complete the increments in your savings plan.

PRO-TIP: Some advisers say that you can keep the checklist, but not necessarily follow the specified amount for that week. You can opt to save the higher amounts on the weeks that you make more money (e.g., when bonuses come), and just save the lower amounts during your lean weeks (e.g., weeks when expenses are more, like during school enrolment period). You just need to mark the amounts that you’ve set aside in your savings plan.

The 50-Peso Ipon Challenge

This is another popular Pinoy savings challenge as it is not complicated to follow. In this challenge, you just put in P50 every week into your savings pot. It’s very simple to follow as you have a fixed amount that you need to put in on the day of the week that you’ve specified. For instance, you just set your ‘rule’ that you put in P50 every Friday morning. At the end of 52 weeks, you will have P2,600 in total.

PRO-TIP: You can opt to modify this based on your needs and what you can commit to stick to. You can set a different interval (e.g., every payday or every month instead of every week); or set a different amount. Just make sure that you stick to the savings plan that you have chosen.

Of course, opting to put a smaller amount gives you smaller savings at the end of the year (P1,040 for P20 per week); and the higher amount will yield higher savings (P52,000 for P1,000 per week). Also, you do not need to stop at 52-weeks. You can continue on for more years, and even choose to put in a higher amount weekly moving forward.

The Loose Change Pinoy Savings Challenge

In this challenge, you just put into the jar / piggy bank all your loose change at the end of the day. It’s easy enough to follow that even young kids can do it.

However, it may not be the most practical savings challenge once you look into liquidating your coins or putting them into the bank. It’s not easy to bring all your saved coins to the bank. Imagine how heavy this can get, and how hard it is to sort out and count. Also, another disadvantage is being able to set the target amount when you start out your Pinoy savings challenge since the amounts can vary every day. Lacking such a structure can eventually lead to you not really pushing yourself towards saving.

Envelop Pinoy Savings Challenge

This is an offshoot of the Envelop Budgeting System that some people use. In this budgeting system, once the income comes it, the money is automatically divided to different envelops marked for Fixed / Recurring Expenses like Rent, Tuition, Loan Payments, etc. Following this, an envelope is set aside for Savings.

PRO-TIP: Put structure and targets on this Pinoy savings challenge by putting the actual amount targeted on the envelope. Once you’ve reached that amount, start a new envelope with the set (or higher) amount. You can also opt to put on the envelope motivators (like the photo of a target investment/photo of dream travel destination).

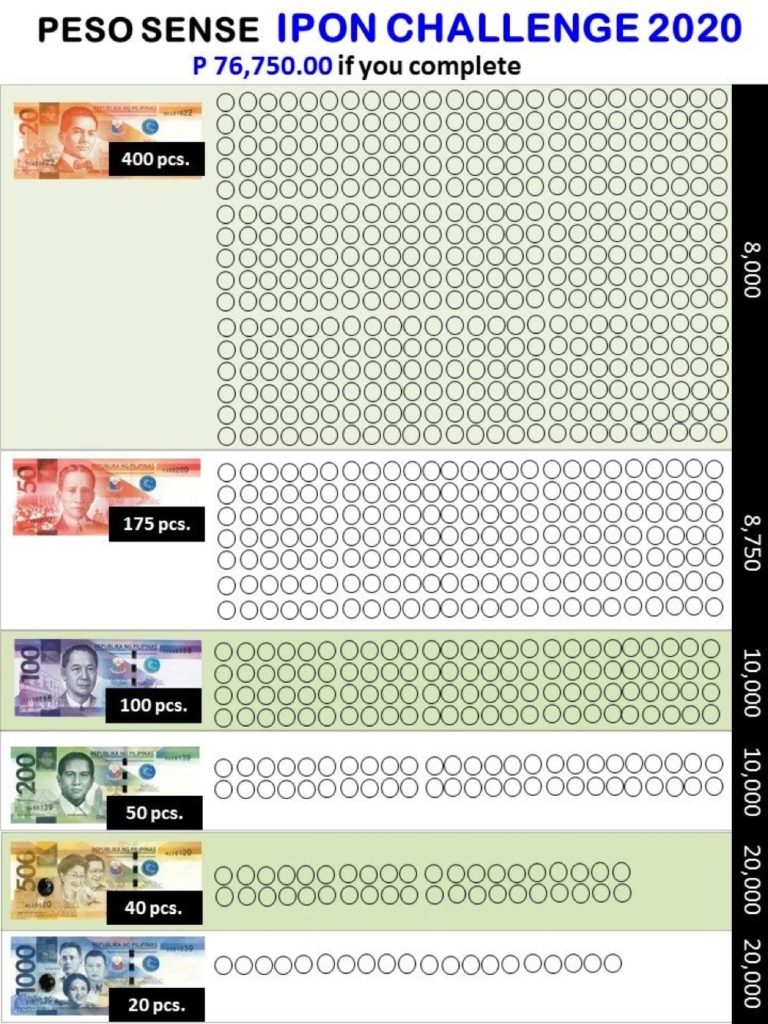

Ipon Challenge from Peso Sense

This challenge was created by the financial awareness page Peso Sense. It was originally intended for Overseas Filipinos and their dependents to take up the habit of saving.

The goal is to save / set aside the specific number of Philippine peso bills in the plan for the entire year. There is no set frequency and pattern. It gives the saver that flexibility, as long as you can complete the checklist.

The disadvantage of this though is that it gives the saver too much flexibility. You would need a lot of discipline to really follow it. You can put in your own rules where you put in the bills on specific frequencies; or put it in tandem with other saving plans. You can also put in trade-offs like setting aside all the money you save by giving up movies or a premium iced coffee in a given week, etc. This will help you to be conscious of putting into saving the money that you get, either directly from your income once you receive it; or money that you opt to save instead of spending on a discretionary spending item.

Taking on a Pinoy savings challenge takes a lot of commitment and discipline. You can consider putting the money in the bank as the amount becomes bigger. This can help ease the ‘temptation of dipping into the pot’ as the weeks go by. Check this site for comparison of the savings accounts in the different banks in the Philippines. Choose one that fits your needs the most.

Good luck on the SAVINGS CHALLENGE you want to start. Go ahead and start today. You don’t need to wait for January 1 to start your Pinoy savings challenge.

Next challenge after this is looking at ways on how your savings can grow via investments and other avenues that can generate passive income. But that’s for another blog. Watch out for it under the Lifestyle section in our site.